How to calculate work in progress cost

what is a cost calculation

Cost calculation means not only calculating the total cost of the goods ,it also finding the cost of each department of the company and its cost at each stage of the goods

cost calculation rule of account

Only expenses and income related to the company is goods and services should be recorded in the cost account .

The cost calculation method will vary depending on the items

The simple cost sheet method can be used for products that end in a process

The process cost method can be used for products that end in multiple process (Milk products )

Each process must cross three stages ,At each of these stages the cost of the goods must be calculate

The calculation method is two types

- Calculating the cost of goods at each stage

- Calculating the cost of goods at stages between stage

example of one process

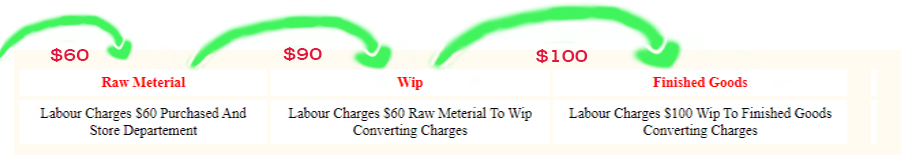

- rawmaterial ⇉ WIP ⇉ finished goods

example of two process

- rawmaterial ⇉ WIP ⇉ finished goods ⇉ rawmaterial ⇉ WIP ⇉ finished goods

Calculating the cost of goods at each stage

Transaction Details Of The Chair Manufacturer Company ..... .....

Direct cost

| Raw Material | . | work in progress | . | finished goods | |||

|---|---|---|---|---|---|---|---|

| transport charges | 10 | . | electric charges | 20 | . | electric charges | 20 |

| labour charges | 60 | . | labour charges | 90 | . | labour charges | 100 |

| Raw Material (unit $200) | 1000 | . | Cutting Machine Charges | 20 | . | cutting & fitting expenses | 60 |

Indirect cost

| Factory Overhead 40% on Labour | . | Office & Admin Overhead 10% on Work Cost | . | ||

|---|---|---|---|---|---|

| Factory Supervisor | 60 | . | OfficeFurnitureDepreciation | 20 | . |

| Factory Insurance | 5 | . | Salary | 70 | . |

| Factory Electric Charge | 15 | . | Telephone And Postage | 5 | . |

| Maintenance Charges | 20 | . | Offices Maintain | 10 | . |

month stock usege

- The Production Of 30 unit (WIP) (At $29.7 Per Unit) Wood Pieces Was Made By 4 Pieces Of Wood (raw materials )

- The Production Of 160 (finished goods) (At $5.225 Per Unit) Chair Was Made By 20 Pieces Of Wood(WIP) /scrap $250

The direct cost of each stage can be easily calculated but the indirect cost can not be calculated because the indirect cost is the cost of the total department.so Each stage is divided based on the indirect cost percentage % to calculate the cost of the goods

If the cost of each sector cannot be calculated from the total cost it can be calculated based on the percentage

Example of indirect cost

Most of the costs incurred for the factory depend on the direct labour so the factory cost can be calculated on the basis of direct labour

Factory Electric Power ,stationery ,Insurance,

It is not easy to figure out how much these types of costs have cost each sector so it is a good calculation method to calculate based on direct labor

you know that management is related to every activity of the company so it is a good practice to calculate the administrative costs from the Gross work cost

indrect cost

fatctory cost: The total direct labour must first be calculated $250 and factory cost $100

calculate (100 *100/250 = 40)

40% of the direct labour is factory cost

administrative cost total direct cost (d labour $250, d exp $130 +d metertrial consumed $800 - scrap $ 250) + fector cost $100 = work cost $1030 ,administrative cost $103 (103*100/1030=10)

10% of the gross work cost is administrative cost

| Particualr | Purchased Raw Materials | closing Materials | Materials consumed | scrap vaue | Materials cost | direct labour | direct exp | prime cost | Factory Overhead 40% of labour | Factory & work cost | W I P opening | W I P closing | Office & Admin Overhead 10% of work cost | Cost Of Goods Production | unit |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| raw material cost (708) | 1000 | (-)200 | 800 | 250 | 550 | 60 | 10 | 620 | 24 | 644 | - | 64.4 | 708.4 | ||

| WIP cost (30unit.cost..$891) per unit cost $29.7 | - | - | - | - | - | 90 | 40 | 130 | 36 | 166 | - | - | 16.6 | 182.6 | |

| finished goods cost | - | - | - | - | - | 100 | 80 | 180 | 40 | 220 | - | - | 22 | 242 | |

| total cost 160 unit $836 per unit cost $5.225 | 1000 | (-)200 | 800 | (-)250 | 550 | 250 | 130 | 930 | 100 | 1030 | (-)297 | 103 | 836 | 160 |

Calculating the cost of goods at each stages between the stage

how to calculate loss and WIP on 70% or 40% .....?

example of direct cost

The production for a week in the "H" department is 30 and the Direct cost is $ 57 But the output is 25 units and the remaining 5 units are 70% percent complete and the Direct cost is $ 57

Direct costs should also be calculated on a Percentage basis if the actual output is different from the expected output

Expected production is 30 units and direct cost is $ 57 But in reality the output is 25 units and the remaining 5 units are 70% work in progress

Calculate the unfinished units based on the percentage ( The same method can be calculated if the products are damaged or loss during production

Calculating in percentage terms is not an accurate calculation method but it does not cause any error in the calculation

160 units were cut to carry the materials in the second stage to the third stage but only 150 units were fitted and The remaining 10 units are 90 percent complete

- wip to finished goods conveting labour charges $100 and direct expanses $80 direct material cosumend 100%

If you do not calculate the cost of the goods at each stage you have to calculate from the total cost

If you are calculating the cost of goods at each stage you only need to calculate the cost of the place where the unfinished goods

- (100/159=0.6289)WIP 0.6289 * 9 = 5.7 & finished goods 0.6289 * 150 = 94.3

direct labour

- (80/159=0.5)WIP 0.5 * 9 = 5 & finished goods 0.5 * 150 = 75

direct exp

- (594/160=3.7)WIP 3.7 * 10 = 39 & finished goods 3.7 * 150 = 555

wip meterial

indirect cost

- fectory (40/159=0.25)WIP 0.25 * 9 = 2.25 & admin (22/159=0.138)WIP 0.138 * 9 = 1.242

fectory and admine overhead

| particualr | amount |

|---|---|

| d material cost | 39 |

| d labour cost | 5.7 |

| d expenses cost | 5 |

| fectory & admin over head | 3.5 |

| total working progrss of 10 unit 90% cost | 53.2 |

| particular | Amount | Amount |

|---|---|---|

| purchased raw materials | 1000 | |

| closing raw material | 200 | |

| raw material consumed | 800 | |

| scrao value | (-)250 | |

| direct material | 550 | |

| direct expenses | 130 | |

| direct labour | 250 | |

prime cost | 930 | |

factory overhead (40% of labour) | 100 | |

(+) opening W I P |

- | |

(-) closing |

350 |

|

closing W I P |

(+)297 | |

closing W I P 90% | (+)53 | |

factory & work cost | 4730 | |

office & admin overhead (43% of work cost) | 103 | |

cost of goods production | 783 |

topics